Keeping up with KRA updates is no longer optional for businesses operating in Kenya. The Kenya Revenue Authority continues to modernize tax administration, tighten compliance requirements, and expand digital enforcement mechanisms. For business owners, directors, and finance managers, understanding these changes is critical to avoiding penalties, managing cash flow, and maintaining regulatory compliance.

This article breaks down the most important KRA updates, explains their practical impact on businesses, and outlines how professional tax advisory support can help you stay compliant and financially efficient.

Why KRA Updates Matter to Kenyan Businesses

KRA updates directly affect how businesses register, file, pay, and report taxes. Even minor regulatory changes can have significant implications, including:

Increased compliance costs

Higher exposure to audits and penalties

Cash flow disruptions due to unexpected tax liabilities

Operational risks arising from non-compliance

With KRA increasingly relying on data-driven systems and real-time reporting, businesses that fail to adapt are more likely to face enforcement actions.

Key Areas Covered by Recent KRA Updates

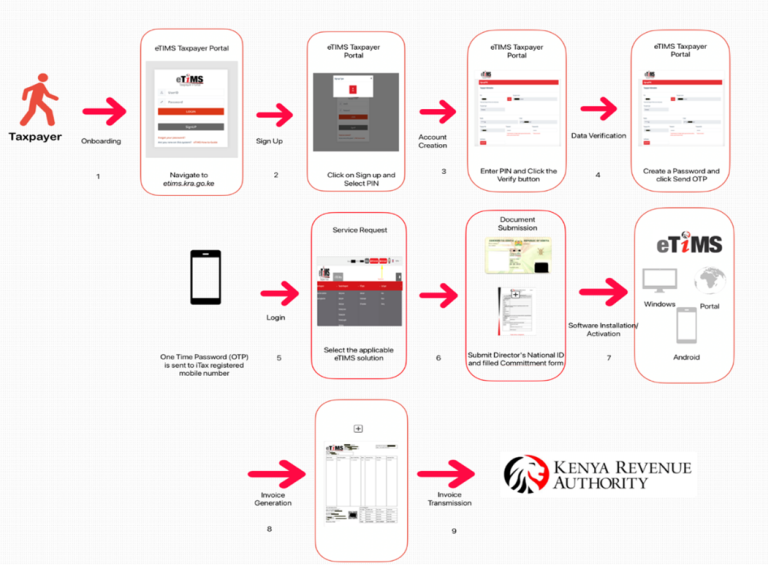

1. Digital Tax Systems and Automation

One of the most impactful KRA updates is the continued expansion of digital tax platforms. Businesses are now expected to:

File returns electronically

Maintain accurate digital records

Integrate sales and invoicing systems with KRA platforms where applicable

These systems allow KRA to cross-check data across VAT, income tax, PAYE, and withholding tax. Any inconsistencies are quickly flagged, increasing audit risk for non-compliant businesses.

What this means for your business:

Your accounting records must be accurate, timely, and fully reconciled. Manual or informal bookkeeping significantly increases compliance risk.

2. VAT Compliance and Reporting Changes

VAT-related KRA updates have become a major compliance focus, particularly for registered businesses. Common areas under scrutiny include:

Input VAT claims without proper documentation

Late VAT filings and payments

Mismatches between declared sales and system-generated data

KRA has also intensified enforcement against non-registered businesses that exceed the VAT registration threshold.

Business impact:

Errors in VAT reporting can result in penalties, interest, and denial of input tax claims. Regular VAT reviews are now essential.

3. PAYE and Employment Tax Enforcement

KRA updates increasingly target employment taxes, especially PAYE, NHIF, and NSSF-related obligations. Employers are expected to:

Accurately compute PAYE for all employees

File payroll returns on time

Remit deductions within statutory deadlines

Discrepancies between payroll records and bank transactions are frequently flagged during compliance checks.

Business impact:

Non-compliance exposes directors to personal liability and may trigger labor-related audits in addition to tax penalties.

4. Expansion of Tax Audits and Investigations

Another critical KRA update is the expansion of desk audits, field audits, and sector-based investigations. Businesses may be selected based on:

Industry risk profiling

Historical non-compliance

Data inconsistencies across tax heads

Audits can cover multiple years and often result in additional assessments if records are incomplete.

Business impact:

Without proper documentation and professional representation, audits can be costly, time-consuming, and disruptive.

5. Penalties, Interest, and Enforcement Measures

KRA updates have strengthened penalty enforcement mechanisms. Common penalties include:

Late filing penalties

Late payment interest

Penalties for false or misleading declarations

In severe cases, KRA may enforce collection through agency notices, bank account restrictions, or asset seizures.

Business impact:

Poor compliance can quickly escalate into serious financial and reputational risk.

How KRA Updates Affect Different Types of Businesses

Small and Medium Enterprises (SMEs)

SMEs are often the most affected due to limited internal accounting resources. KRA updates require SMEs to adopt formal systems and professional oversight earlier than before.

Corporates and Growing Businesses

Larger businesses face increased audit exposure and complex compliance requirements across multiple tax heads. Strategic tax planning becomes essential to manage risk.

Startups and New Registrations

New businesses must align with KRA updates from inception. Early mistakes in registration, VAT treatment, or payroll setup can create long-term compliance issues.

Practical Steps to Stay Compliant with KRA Updates

To manage the impact of ongoing KRA updates, businesses should:

Conduct regular tax compliance reviews

Maintain accurate and up-to-date accounting records

File all tax returns on time, even when no tax is payable

Seek professional advice before responding to KRA notices

Implement internal controls around invoicing, payroll, and reporting

Proactive compliance is significantly less costly than corrective action after enforcement.

How Adamjee Auditors Can Help

At Adamjee Auditors, we help businesses navigate KRA updates with confidence. Our services include:

Tax compliance and advisory

VAT and PAYE reviews

KRA audit support and dispute resolution

Tax planning and risk management

Accounting and statutory compliance services

Our team ensures your business remains compliant while identifying opportunities to improve tax efficiency and operational clarity.

Final Thoughts

KRA updates are reshaping how businesses in Kenya manage tax compliance. Ignoring these changes exposes your organization to penalties, audits, and operational disruption. Staying informed, prepared, and professionally supported is essential in today’s regulatory environment.

If you are unsure how recent KRA updates affect your business, engaging a qualified tax advisor is the most effective way to protect your interests and ensure long-term compliance.

Contact us today for a consultation on our comprehensive audit, tax, and advisory services.

NAIROBI OFFICE

Park View Heights, Mombasa Road, Floor M3

Contact us: +254 750 053 053

Email: madamjee@adamjeeauditors.co.ke

MOMBASA OFFICE

Suite 401, Motorwalla Building,

Jomo Kenyatta Road

Contacts us: +254 717 908 241

Email: info@adamjeeauditors.co.ke

We are social. Let’s chat!

Serving Clients Across Kenya:

Kitale, Nairobi, Malindi, Kilifi, Embu, Narok, Nyeri, Nakuru, Eldoret, Naivasha, Voi, Lamu, Kajiado, Mombasa, Watamu, Garissa, Kisumu, Thika, Kakamega, Mer