Small Company Audit Exemptions in Kenya: Common Mistakes That Trigger KRA Audits in 2026 In 2026, small companies in Kenya may...

💬 Frequently Asked Questions (Faqs)

What it does: This is the most basic question. It establishes your identity as a full-service audit, tax, and advisory firm for Kenyan businesses, not just an auditor.

What it does: This directly tackles a major sales objection. The answer should focus on expertise, reliability, team size, compliance, and long-term value over short-term cost.

What it does: Provides practical information for clients who want to visit, and establishes your professional presence in both Nairobi and Mombasa.

🏛️ Audit & Assurance

What it does: This is the top question for this service. It educates potential clients on their legal obligations under the Companies Act, qualifying them for your service.

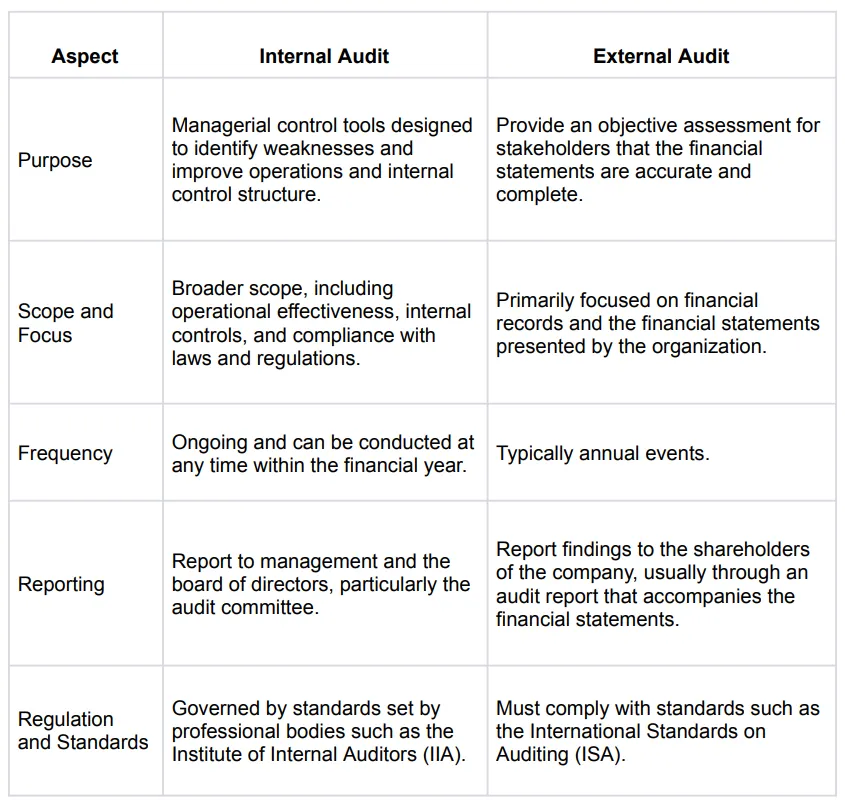

What it does: Clarifies your service offerings. It explains that an external audit is for legal compliance, while an internal audit helps them improve their own processes.

What it does: This sets expectations and shows professionalism. It positions you as a helpful partner, reducing client anxiety about the audit process.

📈 Tax Compliance & KRA

What should I do if I receive a KRA audit notification?

What it does: This is a high-anxiety, high-intent question. Your answer positions you as the immediate, expert solution to a serious problem, generating a high-quality lead.

What is e-TIMS, and does my business need to comply?

What it does: This addresses the most urgent compliance issue in Kenya right now. It captures massive search traffic and establishes you as an up-to-date expert.

My business is dormant or made a loss. Do I still need to file tax returns?

What it does: Catches a common misconception. It saves businesses from KRA penalties and establishes your authority, even for “nil return” clients (who may grow later).

When should my business register for VAT?

What it does: Answers a key legal threshold question for growing SMEs. It helps them stay compliant and identifies them as a potential client for tax services.

What are the main statutory deductions (PAYE, NSSF, NHIF, Housing Levy)?

What it does: This question directly pre-sells your Payroll service. It educates clients on the complexity they face, making “outsourcing” an attractive solution.

📈 Tax Compliance & KRA

What it does: This is a high-anxiety, high-intent question. Your answer positions you as the immediate, expert solution to a serious problem, generating a high-quality lead.

What it does: This addresses the most urgent compliance issue in Kenya right now. It captures massive search traffic and establishes you as an up-to-date expert.

What it does: Catches a common misconception. It saves businesses from KRA penalties and establishes your authority, even for “nil return” clients (who may grow later).

What it does: Answers a key legal threshold question for growing SMEs. It helps them stay compliant and identifies them as a potential client for tax services.

What it does: This question directly pre-sells your Payroll service. It educates clients on the complexity they face, making “outsourcing” an attractive solution.

🧾 Bookkeeping & Payroll

What it does: This is a sales question. The answer (“Focus on your business, ensure accuracy, stay compliant”) overcomes the objection of a client who thinks they can “do it themselves.”

What it does: Explains the process. It reassures a business owner that you will handle everything: calculations, payments, statutory filings, and payslips, removing a major headache.

What it does: Explains a niche, high-value service. It targets international companies or local firms with global operations, showcasing your advanced capabilities.

💼 CFO Advisory & Company Secretarial

What it does: Defines a high-value service. It targets SMEs that need expert financial strategy but can’t afford a full-time CFO, perfectly matching your service to their needs.

What it does: This is a top-of-funnel question. It captures entrepreneurs at “Day 1,” allowing you to be their trusted partner from registration and then upsell them on bookkeeping, tax, and audit services for life.

What it does: Clarifies a often-misunderstood compliance role. It explains that you handle annual returns, manage company registers, and ensure they are legally compliant.

🎓 Adamjee Training

What it does: Defines the target audience for your training arm (e.g., Directors, Accountants, HR Managers, Internal Auditors) so the right people sign up.

What it does: Answers the most important question for professionals (like CPAs) who are required to get annual training. A “Yes” is a powerful conversion tool.

What it does: A simple logistical question that directs users to your most current offers and the training calendar, encouraging a direct registration.

How CFO Advisory Services Help Kenyan Businesses Navigate Regulatory Pressure in 2026 | Adamjee Auditors

How CFO Advisory Services Help Kenyan Businesses Navigate Regulatory Pressure in 2026 In 2026, Kenyan businesses face intensified regulatory pressure from...

Cash Flow Management Strategies for Kenyan SMEs Facing Higher Tax Scrutiny

Cash Flow Management Strategies for Kenyan SMEs Facing Higher Tax Scrutiny in 2026 In 2026, Kenyan SMEs face increasing tax scrutiny...

Audit vs Internal Controls: What KRA and External Auditors Expect in 2026

Audit vs Internal Controls: What KRA and External Auditors Expect in 2026 In 2026, Kenyan businesses face a tighter compliance environment,...

Outsourced Payroll: The Ultimate Shield Against SHIF and NSSF Penalty Traps.

Outsourced Payroll: The Ultimate Shield Against SHIF and NSSF Penalty Traps Managing payroll in Kenya has become increasingly complex, with regulations...

Offshore Accounting for Kenyan Businesses: When It Makes Sense and When It Doesn’t

Offshore Accounting for Kenyan Businesses: When It Makes Sense and When It Doesn’t In 2026, offshore accounting is no longer a...