Audit vs Internal Controls: What KRA and External Auditors Expect in 2026

In 2026, Kenyan businesses face a tighter compliance environment, where the distinction between internal controls and audits is no longer academic—it is central to avoiding KRA penalties, tax reassessments, and audit qualifications. With digital audits, eTIMS expense verification, and automated risk scoring, both regulators and external auditors expect companies to demonstrate robust internal governance and accurate financial reporting.

This advisory guide explains how internal controls differ from audits, what KRA expects, and how external auditors assess controls in 2026 to protect businesses and directors.

What Are Internal Controls?

Quick Advisory:

Internal controls are processes and policies designed to ensure accurate financial reporting, safeguard assets, and promote compliance with laws and regulations. They are proactive mechanisms, not just paperwork.

Key elements include:

-

Segregation of duties

-

Approval hierarchies for transactions

-

Bank reconciliations and reconciled ledgers

-

Documented policies for payroll, procurement, and expenses

-

Monitoring and reporting procedures

Adamjee Advisory Insight (2026):

Internal controls are the first line of defence against KRA digital audit triggers. Weak controls often manifest as bookkeeping errors, PAYE miscalculations, or unsupported eTIMS expenses. Our Bookkeeping Services integrate internal control frameworks directly into daily operations.

What Is an Audit?

Quick Advisory:

An audit is an independent examination of financial records and processes to provide assurance that financial statements are true and fair. It evaluates whether internal controls are effective and whether regulatory obligations are met.

Types of audits in 2026 include:

-

Statutory audits under the Companies Act

-

KRA-focused tax audits

-

Internal audits for operational efficiency

-

Special-purpose audits for compliance (e.g., PAYE, NSSF, SHIF)

Adamjee Advisory Insight:

External auditors in 2026 increasingly combine traditional procedures with data analytics, reviewing eTIMS compliance, payroll accuracy, and expense validations. Our Audit and Assurance Services are designed to align both with Kenyan statutory requirements and SFAI global best practices.

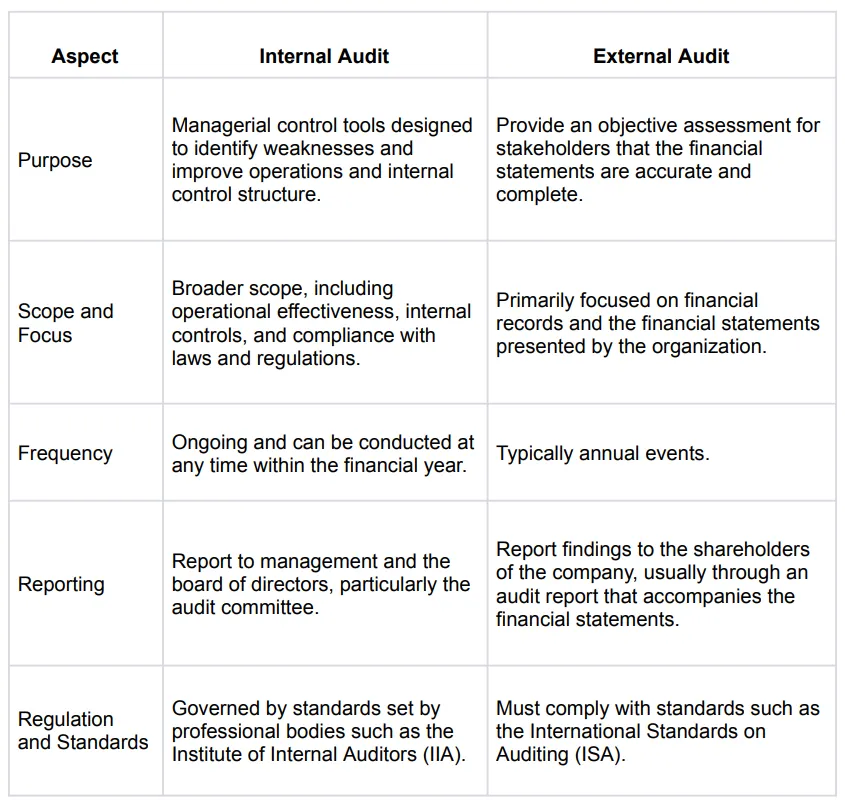

How Internal Controls and Audits Differ

Quick Advisory:

Internal controls are preventative; audits are detective. Controls prevent errors, while audits identify them and provide formal reporting.

| Feature | Internal Controls | Audit |

|---|---|---|

| Objective | Prevent errors and fraud | Detect errors, provide assurance |

| Timing | Ongoing | Periodic or as required |

| Responsible Party | Management / Directors | Independent auditors |

| Focus | Processes and compliance | Financial statements and regulatory adherence |

| Enforcement | Self-monitoring | Regulatory and professional reporting |

Adamjee Advisory Insight:

KRA audits in 2026 focus heavily on whether controls were effective prior to issues, not just on correcting errors afterward. Directors should treat controls as a governance requirement, not a convenience.

KRA Expectations in 2026

Quick Advisory:

KRA expects businesses to have functioning internal controls that support accurate tax reporting. Weak processes lead to disallowed expenses, penalties, and additional scrutiny.

Key KRA expectations:

-

PAYE, NSSF, and SHIF reconciliations are timely and accurate

-

All expenses have valid eTIMS invoices

-

Bank transactions match accounting records

-

Transfer pricing documentation is maintained for related-party transactions

-

Management accounts are reconciled and reviewed

Adamjee Advisory Insight (2026):

KRA now uses automated data matching and predictive analytics, meaning poor internal controls can trigger an audit even if errors are unintentional. Our KRA Audit Survival Guide explains how proper controls reduce exposure.

Why External Auditors Review Internal Controls

Quick Advisory:

Auditors assess whether internal controls are reliable enough to support the financial statements. Weak controls increase the audit scope, risk of qualifications, and director scrutiny.

External auditors focus on:

-

Expense approval and eTIMS compliance

-

Payroll processing and statutory deductions

-

Cash and bank reconciliation controls

-

Inventory and asset safeguarding

-

Segregation of duties and authority limits

Adamjee Advisory Insight:

Auditors now use data analytics to test controls rather than just sampling transactions. Our Statutory Audit Kenya – 10 Step Guide shows how businesses can prepare for these deeper assessments.

Common Control Failures That Trigger KRA Audits

Quick Advisory:

Control failures are the fastest way to attract digital audit attention. KRA identifies weaknesses proactively, using system data.

High-risk control gaps include:

-

Missing or delayed eTIMS invoice capture

-

Unreconciled bank or cash accounts

-

Payroll errors affecting PAYE, NSSF, or SHIF

-

Unauthorized related-party transactions

-

Poor documentation of director approvals

Adamjee Advisory Insight:

Weak internal controls are statistically correlated with higher tax assessments. Adamjee Auditors integrates Payroll Services and Bookkeeping Services to create audit-ready records.

Strengthening Internal Controls in 2026

Quick Advisory:

Strong controls reduce audit risk, improve compliance, and protect directors from personal liability.

Key steps:

-

Document all policies and procedures

-

Enforce segregation of duties

-

Automate bank reconciliations and expense approvals

-

Conduct regular internal audits

-

Train staff on compliance updates (PAYE, NSSF, SHIF, eTIMS)

Adamjee Advisory Insight:

Our Training Webinars help management and finance teams implement controls aligned with KRA and statutory audit expectations.

Audit Readiness Checklist for Directors

Quick Advisory:

Directors are ultimately responsible for internal controls and must proactively verify them.

Checklist:

-

Are management accounts reconciled monthly?

-

Are eTIMS invoices reviewed and approved before payment?

-

Are payroll, NSSF, and SHIF deductions accurate?

-

Are internal control breaches documented and resolved?

-

Have previous audit recommendations been implemented?

Adamjee Advisory Insight:

Directors who ignore controls face personal liability under the Companies Act. Our CFO Advisory Services guide boards on maintaining defensible oversight.

SMEs vs Large Businesses: Control Expectations

Quick Advisory:

KRA and auditors adjust expectations by size, but poor controls are penalized in all cases.

| Area | SMEs | Large Companies |

|---|---|---|

| Audit frequency | Risk-based | Routine |

| Control sophistication | Basic | Detailed |

| Penalty impact | High | Moderate |

| Director involvement | Often limited | Required |

Adamjee Advisory Insight:

SMEs often underestimate control requirements. Adamjee Auditors provides scalable Audit and Assurance Services for businesses of all sizes.

Final Thoughts: Controls Are the First Line, Audits Are the Check

In 2026, internal controls are proactive defenses; audits are verification mechanisms. Businesses that invest in proper processes, reconciliations, and approvals not only survive KRA digital audits—they also benefit from smoother financial management, reduced penalties, and stronger governance.

Gain Clarity and Confidence in Your Finances

Navigate the complexities of compliance, tax, and financial management with a trusted partner. Adamjee Auditors, a member of Santa Fe Associates International (SFAI), provides world-class audit, tax, and advisory services to help your business achieve its goals.

Schedule a consultation with our expert team in Nairobi or Mombasa to discuss your business needs.

Nairobi Office

Park View Heights, Mombasa Road, OR Mbandu Complex, Langata Road

+254 717 908 241

madamjee@adamjeeauditors.co.ke

Mombasa Office

Suite 401, Motorwalla Building, Jomo Kenyatta Road

+254 750 053 053

info@adamjeeauditors.co.ke

https://adamjeeauditors.com/